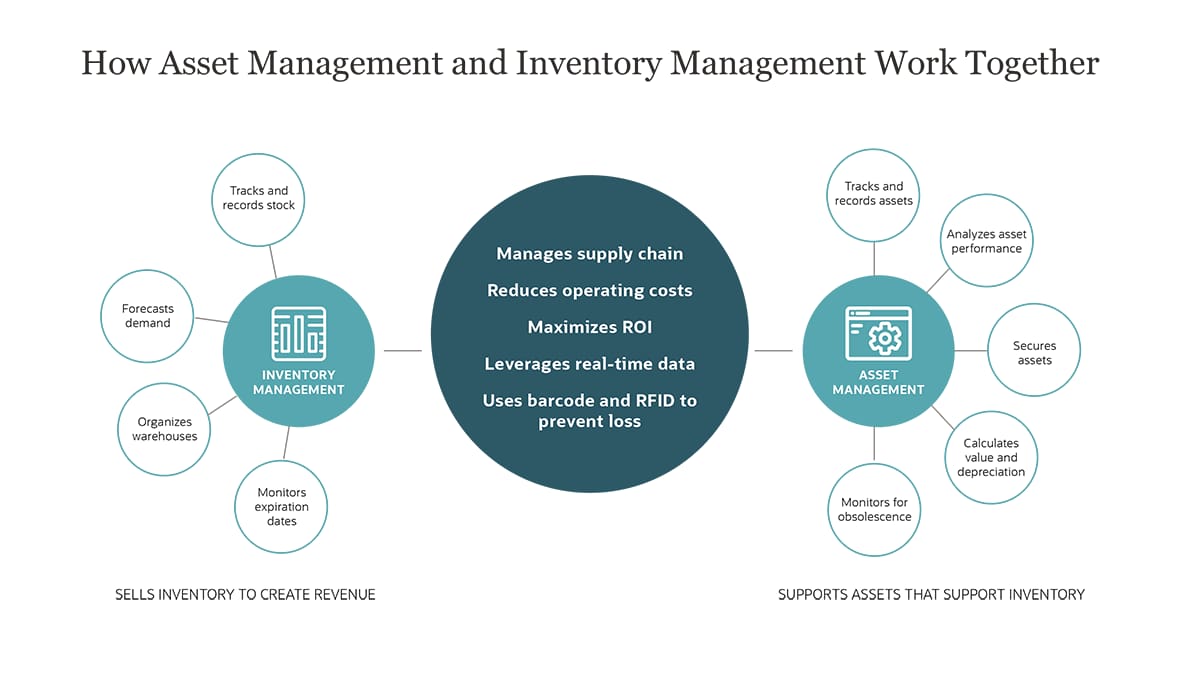

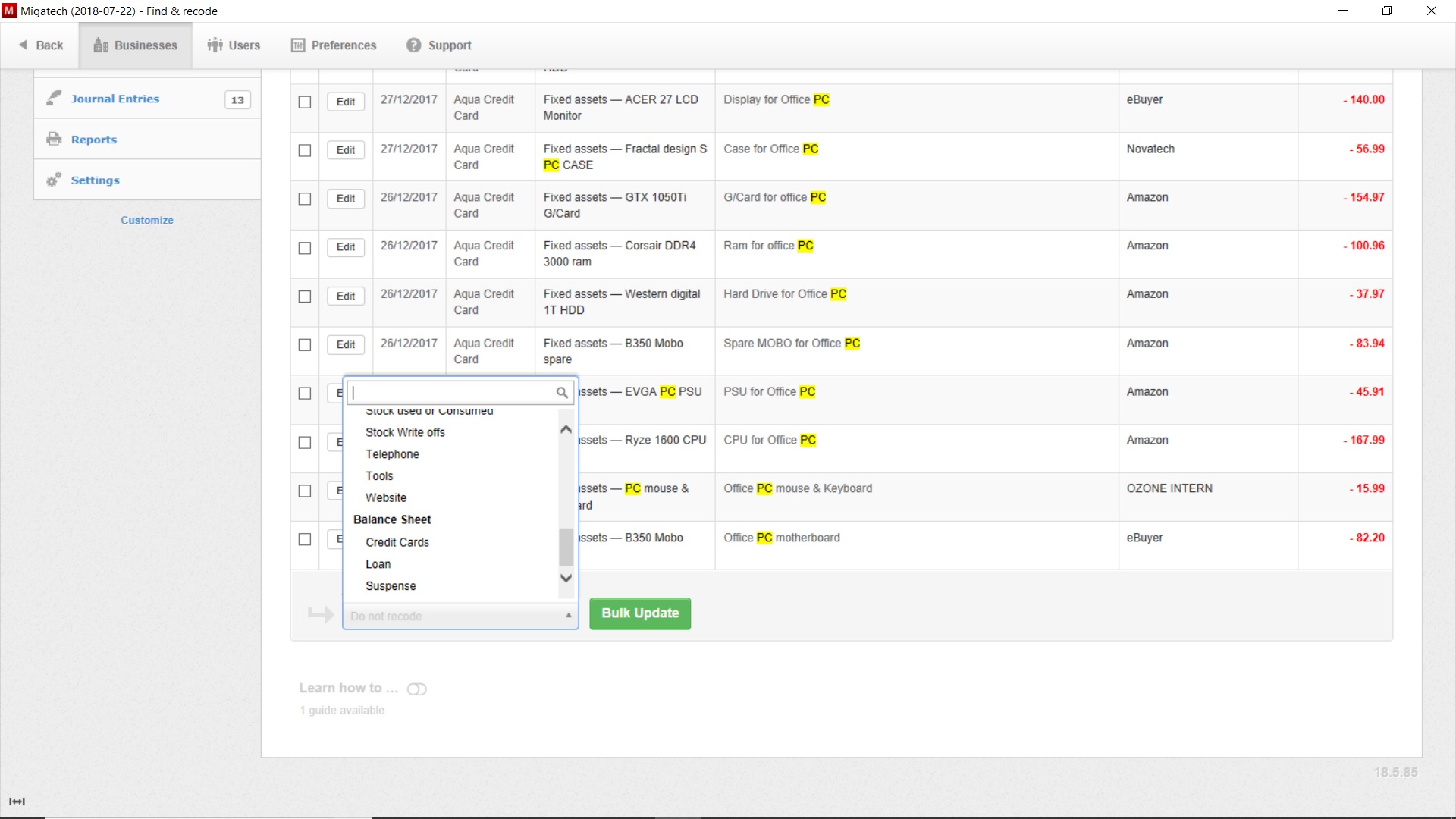

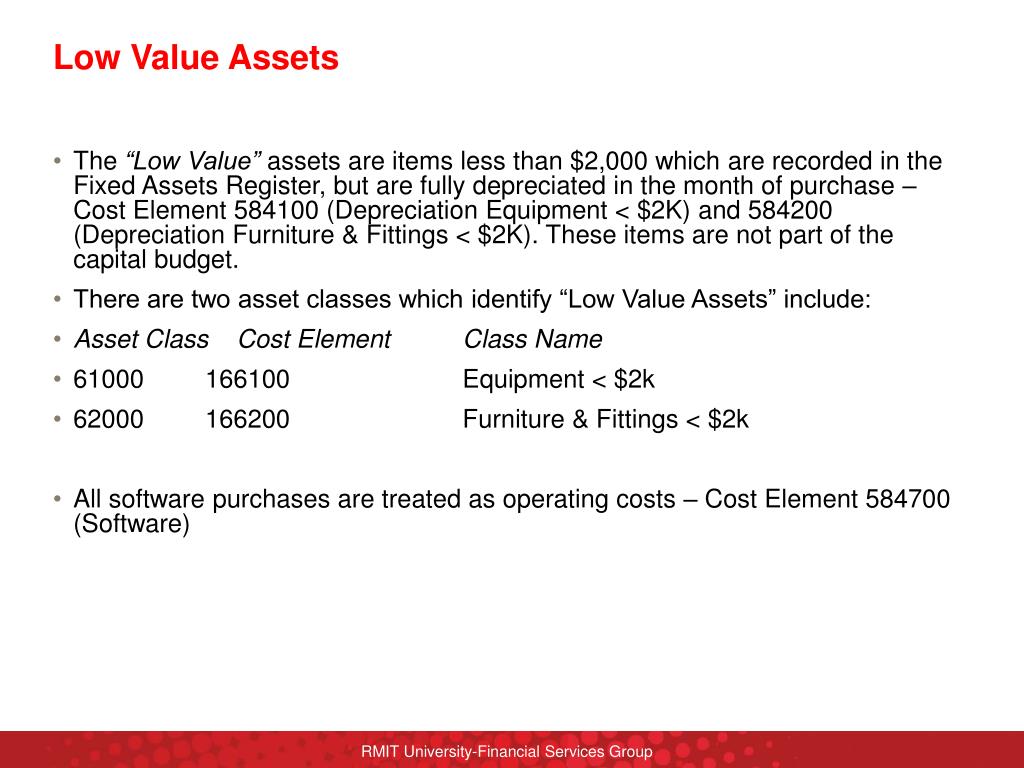

Differences in Accounting Topic: Fixed Assets. Overview Fixed Assets Depreciation: straight-line method or declining-balance method. Low value asset: - ppt download

Differences in Accounting Topic: Fixed Assets. Overview Fixed Assets Depreciation: straight-line method or declining-balance method. Low value asset: - ppt download

Differences in Accounting Topic: Fixed Assets. Overview Fixed Assets Depreciation: straight-line method or declining-balance method. Low value asset: - ppt download

Short term or low value asset under lessee accounting (Lecture 5) | In this lecture you will learn the accounting treatment for short term and low value assets under IFRS 16 leases.

:max_bytes(150000):strip_icc()/BasisValue_Final_4200873-97707377187e4d319618c42a099ca055.png)

:max_bytes(150000):strip_icc()/residual-value-4190131-final-1-c98e52a4e3474d248acab1a8807b1eca.png)

:max_bytes(150000):strip_icc()/COST-OF-CAPITAL-FINAL-fd03399040114d22a1035a573e672ecb.jpg)

:max_bytes(150000):strip_icc()/TermDefinitions_fixed-capital_final_3-2-b428c2a40041407a9d0753d6c3019ea3.png)

:max_bytes(150000):strip_icc()/ImpairedAsset_v1-194942e3fa084c20b987a9b77c5baedd.jpg)

:max_bytes(150000):strip_icc()/WORKING-CAPITAL-FINAL-a6e7622f373e4210bd6d9eace32bdc82.png)